Turning complex data into clarity: A guide to building effective reports

Our approach that we recommend when tackling data visualisation and reporting from complex data structures.

All the latest Data Strategy news.

Our approach that we recommend when tackling data visualisation and reporting from complex data structures.

A data strategy is a vision for how your organisation will generate, process, organise and share data, so you can maximise its value. We believe there is a clear process for developing and embedding a data strategy within the private capital markets. And this is how we typically do it.

In our global practice we recently completed a 14-month project with a leading US head quartered alternative asset management business with in excess of $500bn AUM. They asked us to design a solution to migrate over 1,000 users from their existing DealCloud site, which required the maintenance of multiple versions

Our CEO, Bertie Heyman, recently featured in the latest edition of the Drawdown magazine, providing his thoughts on how Private Markets businesses should structure their internal teams and why he believes that external support at key stages is the best route for businesses to take. Here’s what Bertie had to

We are delighted to have launched a new series of explainer videos. A series of bite-sized videos that look at some of the challenges our clients typically face and how we can help them solve these. To kick things off, in the glorious sunshine, our CEO Bertie Heyman takes a

In the latest in our insight series, we explore six reasons why a private equity (PE) firm might choose to build its own proprietary data warehouse. Using enterprise technologies such as Azure or Snowflake. Control Having its own data warehouse gives PE firms complete control over its data. They can

Private equity firms often deal with vast amounts of complex data related to their investments, portfolio companies, and forward-thinking market research. More often than not, this data is sourced from multiple internal and external systems, such as financial statements, investor reports, and market research databases. To effectively manage this data,

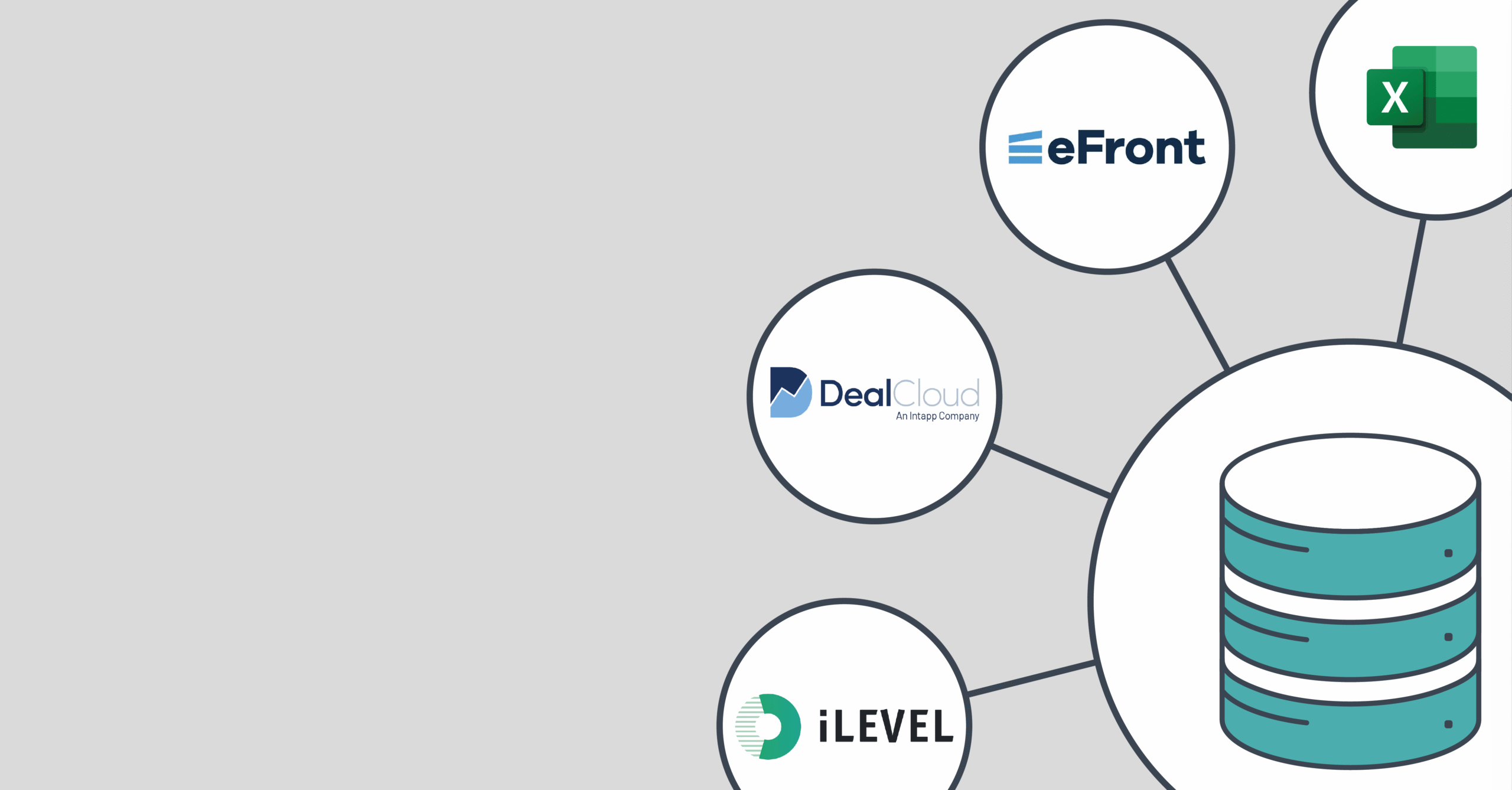

We are delighted to announce the launch of Connect, our new private capital-focused data integration platform. Connect is an innovative solution that empowers private capital firms to integrate their data quickly and easily. Thereby enabling them to move data seamlessly across systems, teams, and platforms. With Connect, firms can gain

The rapid evolution and growth of the private capital markets has accelerated the demands and opportunities faced by sponsors and allocators. But technology enhancements and digital transformation can drive significant and meaningful change. Our latest infographic looks at what you can do and how we can help. You can find

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |